Which industries in Vietnam will benefit from reopening? News 24/09/2021

VinaCapital experts evaluate that the aviation, retail, consumer goods, and construction materials sectors will significantly benefit from the reopening of the economy in Vietnam.

According to VinaCapital’s assessment, the Vietnamese economy will gradually reopen from mid-October and is expected to fully reopen by the end of 2021. The government has also shifted its strategy from “Zero Covid” to “Living with Covid-19.”

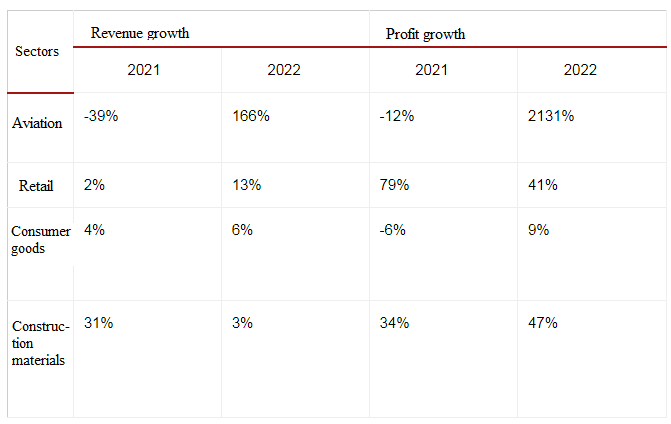

The group has provided forecasts on the revenue and profit recovery for several sectors that could benefit from these developments. VinaCapital refers to this group as “reopening stocks” because they can easily separate the impacts of reopening the economy.

For example, the banking sector will clearly benefit from the reopening of the economy, but it is also influenced by various factors, including government policies on non-performing loans, which can impact banks’ profitability.

For the aviation sector, VinaCapital notes that domestic air travel volume in Vietnam is currently only at 90% compared to pre-Covid-19 levels.

“We expect domestic flight operations to nearly recover to pre-Covid-19 levels by the end of 2022 based on the current vaccination rate, while international tourism may not recover until mid-2022. This means that overall air passenger volume will still be lower by 20% compared to pre-Covid-19,” VinaCapital forecasts for the aviation industry in the coming year.

According to the experts from the group, the airline industry’s profit is projected to increase by over 2,000% in 2022. This forecast excludes Vietnam Airlines due to the government support received by the company, which has made it difficult to forecast future earnings per share (EPS).

Another note is that airlines have high fixed costs (high operating leverage), therefore, revenue is forecasted to grow by only 166% in the coming year. VinaCapital further adds that stock prices of these companies are also unlikely to increase by 2,000% since investors are generally optimistic about the long-term prospects, resulting in only a slight decrease of airline stocks by less than 10% since the beginning of the year.

Regarding the retail sector, stricter social distancing measures have been implemented in Ho Chi Minh City for over 3 months, including a month-long period of people staying at home. This is the strictest social distancing level in Southeast Asia.

As a result, retail chains in Vietnam have had to close around 60-80% of their existing stores. VinaCapital cites examples such as PNJ closing 336 jewelry stores, Mobile World Investment Corporation (MWG) closing 2,712 electronics stores, FPT Retail suspending operations of 625 mobile phone stores… with the expectation of reopening from November.

On the other hand, convenience stores and pharmacies remain open regularly during the social distancing period, such as 949 Bach Hoa Xanh stores (under MWG) and 268 Long Chau pharmacies (under FPT Retail).

VinaCapital forecasts that the retail sector’s profit will grow by 79% in 2021 and 41% in 2022. Image: Nhat Sinh.

“The revenue of MWG may have declined an additional 10% without the significant contribution from Bách Hóa Xanh. Meanwhile, the strong growth of Long Châu this year has also helped elevate the average growth rate of the retail industry. Therefore, we have lowered the profit growth forecast for the retail sector in 2022 compared to the high level in 2021″, VinaCapital explains.

Furthermore, retail companies have also benefited from customers being forced to adopt online ordering, thus boosting the prospects of the e-commerce industry. Prior to Covid-19, the share of grocery shopping in modern retail chains was less than 10% due to consumer’s preference for traditional market shopping.

VinaCapital predicts that retail stores in Vietnam will experience an increase in revenue as the economy reopens, driven by pent-up demand. For example, many young couples have had to postpone their weddings due to Covid-19, leading to an expected 5% increase in revenue for PNJ (a jewelry retailer) when they are rescheduled for the following year. While e-commerce retailers have maintained a portion of their sales through online channels this year, the prospects for revenue are lower than that of the jewelry sector due to the compression of demand.

Countries around the world have also witnessed an economic boom as they reopen, fueled by the release of pent-up demand for various products. However, the recovery prospects in Vietnam may not be as explosive because the accumulated savings of the population are not substantial enough to unleash significant demand upon reopening.

”Vietnamese consumers have been stockpiling essential products ahead of social distancing measures. The sales of milk and packaged food products have increased by approximately 2-3% this year, a relatively low growth rate due to the impact of reduced incomes. However, the sales of essential consumer goods experienced a sharp surge of 7% before the implementation of stricter measures, which is expected to gradually decline towards the end of the year”, VinaCapital analyses.

In the construction materials sector, real estate and infrastructure projects have been temporarily suspended since July due to difficulties in labor mobility. The volume of construction materials sold in the domestic market has decreased by 50% in July and continued to decline in August.

Therefore, VinaCapital forecasts that the revenue growth of the industry could reach 31% this year, thanks to the performance of major companies (such as Hoa Phat and Vicem Ha Tien) in the export market. However, if we exclude the export volume, the overall industry revenue may decrease by 20% instead of the anticipated 31% increase.

VinaCapital’s experts also anticipate a breakthrough in Vietnam’s infrastructure construction sector in the coming year. Public spending on infrastructure is expected to increase by 20% in 2021, but the actual results in the first eight months of the year have decreased by 16% due to the impact of Covid-19. A significant portion of the public spending for 2021 may be shifted to 2022 as the government aims to support economic recovery in the following year.

Construction companies continue their work into October to complete major projects, which will contribute to their additional revenue and profit in the upcoming months. However, revenue recognition depends on various factors, and the overall outlook for this sector remains optimistic.

Source: https://zingnews.vn/nhung-nganh-nao-o-viet-nam-huong-loi-sau-tai-mo-cua-post1265823.html